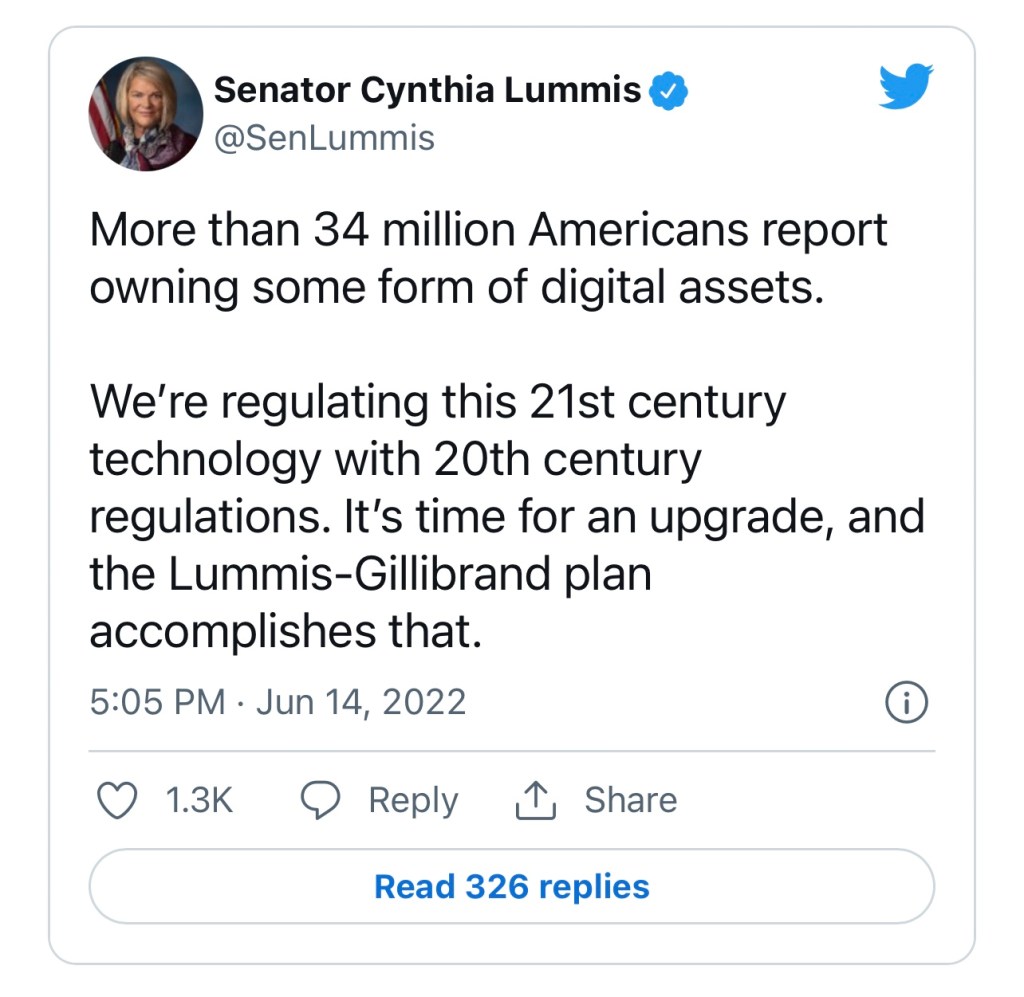

Sen. Lummis Says We should Be Regulating Crypto The 21th Century Way.

U.S. Senator Cynthia Lummis has just shared a Twitter saying that a whopping 34 million Americans claim to have digital assets of some kind. She added we are trying to regulate this 21st-century technology with 20th-century regulations. It’s time for an upgrade, and the Lummis-Gillibrand plan accomplishes that.”

This is in reference to the widely anticipated comprehensive cryptocurrency law proposed by Lummis. The particulars of the proposed legislation will very certainly reveal who the influential players are in the ever-expanding world of cryptocurrency lobbying.

Already, it has been the reason for disagreements between the expanding number of trade groups in the business, all of which are supported by rival digital asset firms.

Aides working in both members’ offices have been inundated with recommendations on how to address various issues, including tax policy and rules governing cryptocurrency exchanges.

Lummis, who has had Bitcoin since 2013, said that in the event that the bill is turned into a law, it would differentiate between commodities, securities, stablecoins, digital currencies issued by central banks, and non-fungible tokens (NFTs).

The new regulatory bill was proposed to make the Commodity Futures Trading Commission (CFTC) the major regulator of the business on June 7, when it was presented for the first time by Senators Cynthia Lummis and Kirsten Gillibrand.

This has been advocated by industry leaders and governments who are pro-innovation since it would result in many assets being categorized as commodities rather than securities like business stocks. Michael Saylor, the CEO of MicroStrategy, is her main adviser for the project, and he is known for openly believing that Bitcoin is a commodity, not security.

Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), was quick to raise reservations over the newly proposed crypto legislation, stating that it might undercut the controls that are now in place for the larger industry.